Hello Bitcoiners, Altcoiners and All-coiners!

What a year 2025 has been for digital payments, blockchain and the crypto narrative as a whole. From the revival of privacy coins and two major upgrades for the smart contracts giant Ethereum to the true merging of TradFi and DeFi, 2025 is a testament to the fact that cryptocurrencies are no longer speculative assets but are an integral part of modern finance.

Let’s devour and relive all the highlights of the crypto world in this Crypto Review of 2025, as we manifest that 2026 brings bigger wins and higher peaks.

Biggest Newsmakers of 2025

All-time high for Global Crypto Market Cap Charts

The total market cap of the cryptocurrency market as a whole reached a new high, surpassing $4 trillion in October 2025. While it retracted to $3.03 trillion towards year-end, indicating sensitivity to market shifts, the new peak indicates the market can test newer resistance levels in the coming months. Of the $3.03 trillion, Bitcoin accounted for 57.27% or $1.73 trillion, continuing Bitcoin’s dominance as the market leader.

Stablecoins For The Win!

Stablecoins thrived in 2025 and truly grabbed the centre stage from the long-standing memecoin fest. With regulatory clarity from the GENIUS Act and the EU MiCA Guidelines, big players from Traditional Finance gained confidence to integrate with stablecoins for payments, treasury, and custody. Stablecoins also enjoyed fiat-backed stability than ever before. This crypto sector also saw deviation from general-purpose stablecoins with the introduction of specifically designed coins, such as India’s ARC (Asset Reserve Certificate) Stablecoin, developed by Polygon, and Western Union’s US dollar-backed stablecoin US Dollar Payment Token (USDPT)

While new entrants like Ethena (USDe) and PayPal USD (PYUSD) are gaining traction, major players like Tether (USDT) and USDC still dominate the market.

The Bitcoin Strategic Reserve Is the Standout Development of 2025

In March 2025, the US President Donald Trump established the Strategic Bitcoin Reserve, intending to hold the crypto as a permanent reserve asset. The US positions itself as a leader in digital finance and crypto adoption, holding 198,000-325,000 BTC as of late 2025, making the US Government the largest government holder of Bitcoin. Analysts advocate the move, arguing that a large Bitcoin reserve could serve as a hedge against inflation and national debt. As part of the executive order establishing the Bitcoin Reserve, a US Digital Asset Stockpile was also established for non-Bitcoin cryptos such as Ethereum and Solana.

As a component of the BITCOIN Act, the US Treasury proposed an acquisition of up to 1 million BTC over the next five years, truly bringing the Mighty B into the mainstream.

Ethereum’s Big Corporate Moment

Ethereum’s corporate portfolios have outperformed those of Bitcoin, with BlockRock’s ETH ETF crossing 10 billion USD in AUM. Other Ethereum funds, such as the Grayscale Ethereum Trust (ETHE/ETH), Fidelity Ethereum Fund (FETH), and others, have also grown in volume as Ethereum’s dominance in the tokenized finance space has increased.

Bitcoin Succumbs to Volatility

While Bitcoin has grown in utility and institutional adoption in 2025, the crypto’s yield to date (YTD) this year has been disappointing at approximately -8% as against 120% in 2024. This is Bitcoin's lowest YTD since 2021, marking a year where altcoins have outperformed the Mighty B. This is even though Bitcoin reached a new all-time high this year of $126,210 in October 2025.

Privacy Peaks as Stablecoins Tighten Up Their Strings!

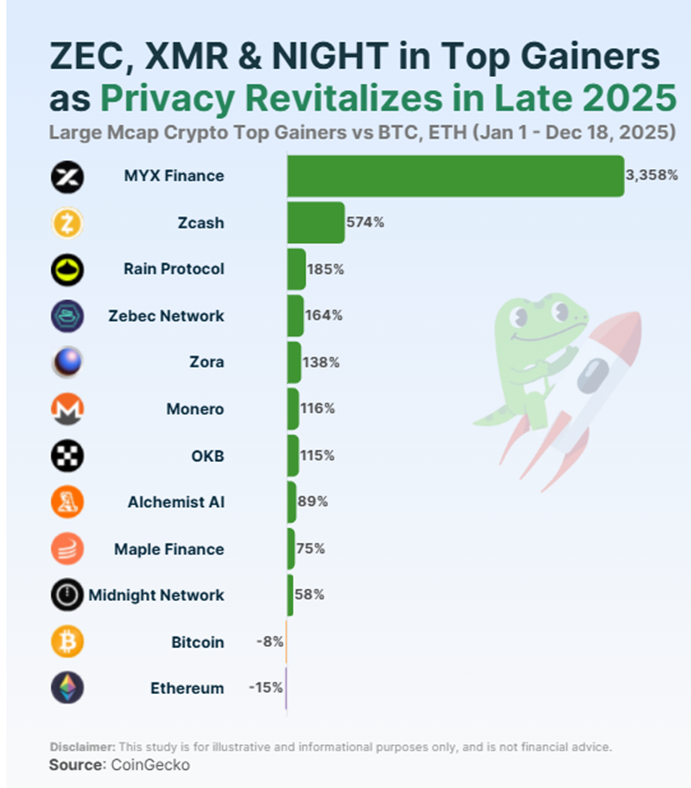

Higher regulatory surveillance and compliance with the introduction of the GENIUS Act have made crypto investors turn towards privacy-focused tokens. The entire privacy-focused cryptos (PFCs) space seems to be making a comeback with Monero (XMR), Zcash, Secret Network (SCRT) and other similar projects enjoying a bullish rally and renewed investor interest. Although privacy-focused projects are facing regulatory scrutiny in Japan, South Korea and some European markets, this did not stop the sector from making big gains this year.

Privacy-focused coins have grown from 9.7% in 2024 to 11.4% this year in terms of global crypto transactions, with the total transaction volume surpassing $250 billion in 2025. The total market cap of the privacy-focused coins also ballooned to $43.4 billion.

Dogecoin and XRP Enter the ETF Ring

In a milestone for both memecoins and payments, Dogecoin and XRP entered the US Spot ETF market. The REX-Osprey DOGE ETF and the REX-Osprey XRP ETF both offer exposure to these digital assets and are a natural extension of investor demand. Both Dogecoin and XRP are leading cryptocurrencies in their respective niches, with strong community support and investor demand.

Developments and Upgrades that Mattered the Most

1. Ethereum Pectra Upgrade & Fusaka Upgrade

Ethereum witnessed two hard forks in 2025, putting this smart contract network at the centre of attention in 2026. The Pectra Upgrade and the Fusaka Upgrade include several Ethereum Improvement Proposals (EIPs) that represent a major leap towards Ethereum’s vision of creating a decentralised, yet scalable and secure, global settlement platform that works like a “World Computer”.

The breakthrough PeerDAS, or Peer Data Availability Sampling, reduces transaction processing costs by 40-60%, drastically reduces storage requirements, and greatly improves Ethereum’s processing capabilities. Aside from this, the increase in the block gas limit, Ethereum Virtual Machine (EVM) improvements and capping execution blocksize limit are all developments that will enable Ethereum to reach greater heights in 2026.

2. Polygon’s Rio Upgrade

Polygon’s Rio Upgrade in October 2025 introduced the Validator-Elected Block Producers (VEBBloP), which enable stateless validation and near-instant finality, features that dramatically cut node costs and enable Polygon to become a high-speed Web3 payments platform. With 5000+ transactions per second and a host of other benefits, the Rio Upgrade brings Polygon closer to its vision of fintech integration, making It a preferred choice for financial institutions seeking fast, reliable settlements. Polygon is also poised to be a key platform for stablecoin transfers given its integration with Stripe, a financial infrastructure platform.

3. Solana’s Alpenglow Upgrade

Solana’s Alpenglow Upgrade is a major system overhaul that replaces Proof-of-History (PoH) and TowerBFT with new components, Votor and Rotor, to achieve near-instant finality, reducing the 12-second delay to 150 milliseconds. With faster speed, new use cases, enhanced security and more, this upgrade received a 98% Yes from validators and is slated for a Mainnet launch in early 2026, which could reshape Solana’s growth trajectory in the coming months. With Ethereum’s Pectra upgrade and Fusaka upgrades successfully realizing benefits for the smart contract platform, Solana’s Alpenglow upgrade will empower Solana to keep pace with Ethereum, true to its tag of being an Ethereum Killer.

Biggest Gainers of 2025

While 2024 witnessed memecoins ruling the roost in terms of biggest gainers, this year sees a welcome refreshing change with chart toppers emerging from varied crypto genres, including derivatives, privacy coins, payments & RWA and social finance among others, with not a single from the top 10 coming from the meme coins space. This marks a change of movement and attention away from speculative tokens to those with strong fundamentals.

1. MYX Finance (MYX) emerged as the top gainer of 2025, clocking in a price return of 3358.15%, achieving its highest yield-to-date (YTD) thanks to its popularity on the BNB chain and its airdrop program, which, in fact, later faced criticism for insider trading. This derivatives protocol began at a modest $0.097 in May 2025 and ended the year at $3.46 apiece.

2. Zcash (ZEC) stood second in terms of gains, marking the big impact of privacy tokens this year. The token registered a YTD of 573.72%, reclaiming price levels it had last seen in May 2022. Interestingly, other privacy coins such as Monero (XMR) and Midnight Network (NIGHT) also featured in the top 10 gainers of 2025, making this sector the biggest gainer of the year.

3. Rain Protocol recorded a gain of 184.83% thanks to the massive investment of $212 million coming from Enlivex Therapeutics as part of its treasury strategy in November 2025. Rain Protocol also gained relevance in the growing prediction markets space and in its diverse use cases.

4. Zebec Network, a decentralised infrastructure network with an integrated portfolio of payroll, retail products, RWA, and more to become a full-fledged finance powerhouse, is a small-cap crypto that has been a breakthrough coin of 2025. With a 164% YTD, Zebec serves hundreds of web3 and web2 businesses in payments and consumer applications. Zebec has definitely got 100x potential in the coming years.

Key Growth Drivers for Cryptocurrencies in 2025

Institutional Adoption across governments, private firms, investment funds, and more fueled growth in 2025. Traditional finance giants such as Sony Bank, Deutsche Bank, Visa, and Mastercard are integrating stablecoins for backend settlement processing. Governments stepped into the ring with Strategic Crypto Reserves, launching their own stablecoins (India’s ARC) and bridging the gap between cryptocurrencies and traditional finance.

Real-World Asset (RWA) Tokenisation grew from $8.5 billion to nearly $34 billion by mid-2025, thanks to cryptocurrencies creating practical utility for traditionally illiquid assets.

Stablecoin Dominance, with higher regulatory clarity, increased fiat currency backing, and increased trading activity in stablecoins, made this sector a growth driver for the entire crypto space.

The True Convergence of AI and Crypto through decentralised identity systems like World App, and exploring how crypto can provide infrastructure and payment rails for AI agents

Spot Bitcoin ETFsboosted demand for Bitcoin, which in turn drove the entire crypto ecosystem into a bullish run.

Improved infrastructure, network upgrades, ecosystem expansion, and higher utility across leading crypto platforms such as Ethereum, Mantle, Solana, and more were key growth drivers.

Words That Made the News!

“Bitcoins Should Be Treated like Cash” Australian Judge Michael O’Connell ruled that Bitcoin transactions should be treated like cash rather than an investment asset like gold and shares.

"ETH will likely be 100x from here. Probably much more" Joseph Lubin, founder of ConsenSys and co-founder of Ethereum.

“2025 marked a clear turning point for the digital asset ecosystem. Decentralised perpetuals are no longer limited to crypto assets. Equity perps and commodity perps like gold and crude oil gained real traction on DEXs this year,” said Wenny Cai, COO of Synfutures.

“With the right legal framework, institutions large and small will be liberated to invest, innovate, and take part in one of the most exciting technological revolutions in modern history. It's so big. It's, I think, as big as you can get. The US will be an undisputed Bitcoin superpower and crypto capital of the world,” US President Donald Trump.

“Stablecoins could reach a total market value of $1 trillion by 2026,” Solana Labs co-founder Anatoly Yakovenko.

What’s Next? All Eyes on Crypto in 2026!

Legislation and regulatory clarity will remain a leading theme for cryptocurrencies in US markets. Many existing CASPs (crypto-asset service providers) under the EU MiCA Guidelines also have variable transition periods, with a maximum of July 1, 2026. The DAC8 directive, which mandates crypto asset tax reporting, also has a final compliance deadline of Jul 1, 2026. All in all, 2026 will continue to see high churn and regulatory consolidation across all cryptocurrency niches.

The convergence of TradFi and DeFi will continue to strengthen in 2026, with several Wall Street firms delving into crypto solutions for payments, real-world asset tokenisation, treasury management, and more.

2026 is set to further consolidate stablecoins as standard treasury tools, with demand and use increasing several-fold. Institutional investment will also rise further, thanks to the regulated stablecoin space and the growing tokenised funds niche.

All in all, 2026 is all set to be an action-packed year for cryptocurrencies, much like 2025 that gripped the attention of analysts, investors, governments, and institutions alike.